Car Loans 101: How To Calculate Your Monthly Payment in Seconds

By CanadaDrives

If it’s time for you to buy a car, then chances are it’s also time for you to secure your car loan too. If you’re like most Canadians, you’ll want access to financing that allows you to pay for your car over time, usually as a monthly or bi-weekly payment that stays the same over a predetermined number of months.

Borrowing money and trying to figure out your monthly or bi-weekly payment when buying a car can be confusing, but we’re here to help. Here’s a breakdown of the terms you’ll hear while organizing financing for your next car, along with a useful tool to help you calculate and budget for your auto loan in seconds.

How do car loans work?

Car loans are easy to understand when you know the basic terminology. Payments on car loans are calculated using three main components:

- the principal (the amount borrowed)

- the interest (the cost of borrowing)

- the term (the length of time)

1. The principal

The principal is the total amount you’ll need to borrow to cover the cost of the item you’d like to buy – in this case, your next vehicle.

This includes the agreed-upon price, plus any add-ons, extra fees, and sales tax. In most provinces, you’ll need to pay provincial sales tax on the cost of the vehicle. In most cases, this amount can be rolled into your loan so that you don’t need to pay it separately at the time of purchase.

You can lower the principal by adding a down payment. For example, if the principal on your new car is $20,000, you could offer a down payment of $2,500 so that you only need to finance $17,500.

It’s possible to secure a loan with no down payment, but some financial institutions require one for approval. The other benefit of a down payment is that you’ll pay less interest. The more money you put down upfront the less money you need to borrow, and with a smaller loan your total interest cost will also be less.

If you have a vehicle to trade in, your trade in can act as a down payment. You can usually trade in a vehicle before the car loan has been fully paid off too. For example, if your vehicle’s market value is $6,000 and you owe $4,000 on it, you will have $2,000 in equity to direct towards your new vehicle’s purchase.

How the principal affects your car payment

Our Car Loan Calculator is a simple but effective tool for illustrating what your car payment could look like based on how much you need to borrow, how long your term will be, and where your credit rating stands. For example, according to the Car Loan Calculator, if you have average credit and want to borrow $20,000 with a 60-month term, your monthly payment will be $425 (or $196 bi-weekly.)

However, if you have a down payment or trade-in worth $4,000, you only need to borrow $16,000 over 60 months, and your car payment is now $340 per month (or $157 bi-weekly.)

2. The interest

Interest is the name for the amount your lender charges to provide you with the loan. This amount is calculated as a percentage of the principal known as the annual percentage rate (APR).

Car loan interest rates vary (usually anywhere from 3% to 20%) and are based on a variety of factors such as the Bank of Canada’s key interest rate and your personal credit score and history.

Car loans are considered secured loans, meaning that the value of the vehicle itself is used as a guarantee that the lender will get its money back if you can’t pay. For this reason, it’s easier to get approved for a car loan at a lower interest rate than it is for an unsecured personal loan for the same amount.

Your credit score affects your interest rate

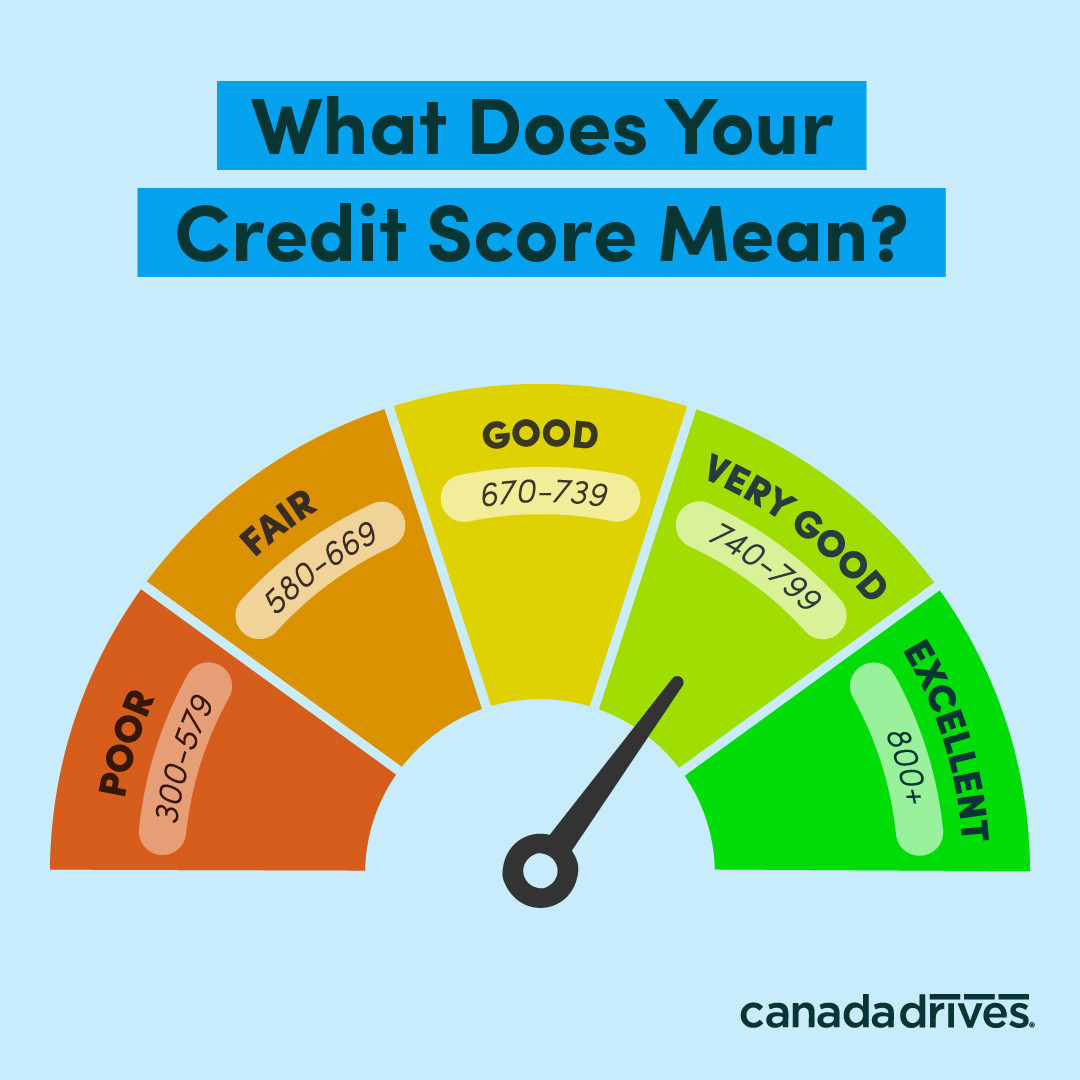

Your credit score is a three-digit number that’s calculated based on how much debt you currently have, your history of making debt repayments on time, and other factors.

Financial institutions use this number to determine their risk of lending money to you. If your credit score is high, it means you have a proven track record with regards to loan repayments. Customers with a score of 800 or more have excellent credit and usually get access to the lowest interest rates on the market.

To know where your credit stands today, you can check your credit score for free with providers such as Borrowell.

How your credit score affects your car payment

According to our Car Loan Calculator, if you want to borrow $20,000 over 60 months and your credit is average, your monthly payment will be $425 (or $196 bi-weekly). But if your credit is excellent, your interest rate will be lower, and your car payment will be $376 per month (or $173 bi-weekly.)

Please note: The Car Loan Calculator illustrates the factors that influence your car payment and only provides a rough estimate of what you can expect to pay.

3. The term (the length of time)

In financial parlance, a loan term refers to how long it will take to pay off your loan in monthly or bi-weekly instalments. Car loans typically have terms between 36 months (3 years) and 72 months (6 years). It’s possible to find shorter loan terms, and longer terms are becoming more common.

Choosing a longer loan term is an easy way to reduce your monthly (or bi-weekly) car payment: it spreads out your payments over a longer period of time, meaning each individual payment is lower. On the other hand, you’ll be paying interest for a longer period of time. It also means you’ll be upside down on your car loan for longer.