Simply Wall St

December 4, 2025

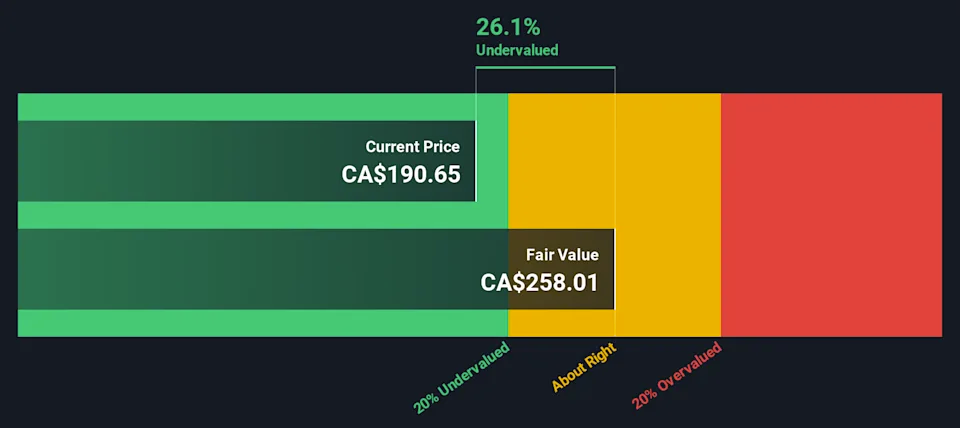

- If you are wondering whether Royal Bank of Canada is still worth buying after such a strong run, or if most of the upside is already priced in, you are not alone.

- The stock has climbed 1.7% over the last week, 5.5% over the past month, and is now up 26.9% year to date and 28.3% over the last year, building on a cumulative 85.8% gain over three years and 148.3% over five years.

- Recently, investors have been reacting to a mix of macro headlines around interest rate paths and regulation in the Canadian banking sector, as well as ongoing consolidation and strategic investments by the big banks. Together, these factors have nudged sentiment to be more optimistic on Royal Bank of Canada, while also raising questions about how sustainable returns will be from here.

- Right now, Royal Bank of Canada scores just 2/6 on our valuation checks, suggesting the market may not be offering a clear bargain. In what follows, we will walk through different valuation approaches to see what is really going on, and then finish with a broader way to think about the stock’s value in the bigger picture.

Royal Bank of Canada scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Royal Bank of Canada Excess Returns Analysis

The Excess Returns model looks at how much value Royal Bank of Canada can create above the basic return investors require on its equity capital, then projects those surplus returns into the future.

On this view, Royal Bank of Canada starts from a Book Value of CA$88.30 per share, with analysts expecting Stable EPS of CA$16.18 per share, based on forward Return on Equity estimates from 8 analysts. After covering an estimated Cost of Equity of CA$7.27 per share, the bank is projected to generate an Excess Return of CA$8.91 per share, supported by an Average Return on Equity of 16.14%.

The model also assumes Book Value compounds to a Stable Book Value of CA$100.21 per share over time, based on estimates from 6 analysts. When these excess returns are capitalized, the Excess Returns valuation implies an intrinsic value around CA$297.93 per share, which the model suggests is about 26.6% above the current share price. On this approach, the stock appears materially undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Royal Bank of Canada is undervalued by 26.6%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

RY Discounted Cash Flow as at Dec 2025

Original:

https://finance.yahoo.com/news/rbc-still-attractive-strong-2025-121207243.html?fr=sycsrp_catchall

Read More:

Why The Narrative Around Royal Bank of Canada Is Shifting After Analyst Upgrades And New Targets