INDER SINGH BISHT NOVEMBER 28, 2025

The US Department of Defense has awarded ElementUSA a $29.9-million contract to support the development of a demonstration facility in Gramercy, Louisiana, designed to separate and purify gallium and scandium from existing industrial waste streams.

This investment aligns with the administration’s push to boost domestic production of processed critical minerals and derivative materials.

Initial development for the project will also take place at ElementUS’ Critical Resource Accelerator in Cedar Park, Texas.

“Gallium and scandium are critical minerals essential to a wide range of defense manufacturing industries and equipment,” Assistant Secretary of Defense for Industrial Base Policy Mike Cadenazzi said.

“Developing domestic production of both is a DOW (Department of War) priority.”

One of 18 granted by the Defense Production Act (DPA) Purchases Office, the award totals $887 million this year.

The DPA Title III award responds to Executive Order 14241 — Immediate Measures to Increase American Mineral Production, issued on March 20, 2025 — and is funded through the Additional Ukraine Supplemental Appropriations Act of 2022.

Chinese Monopoly

Gallium and scandium are critical to US defense manufacturing, with applications in missile defense systems, advanced sensors, next-generation fighter aircraft, and hypersonic weapons due to their high-temperature resistance and electronic performance characteristics.

The US currently produces no domestic gallium commercially and maintains no government stockpile to mitigate supply disruptions or counter potential Chinese export controls.

China accounts for roughly 98 percent of global primary low-purity gallium production, recovered largely as a byproduct of bauxite and zinc processing, giving Beijing significant leverage over global availability and pricing.

This dominance is not due to superior ore deposits, but rather to strategic policy decisions made decades ago to incorporate gallium recovery into aluminum refining.

As a result, China’s vertically integrated system enables producers to offer gallium at prices based on byproduct economics rather than true primary production costs, making competition difficult for other nations.

Scandium markets present different but equally serious concentration risks.

China produces roughly 75 percent of the world’s supply, with Russia and the Philippines trailing as distant second- and third-place producers.

In addition to this upstream concentration, the scandium supply chain relies on multiple intermediary processing stages, any one of which can be disrupted by geopolitical tension or trade instability, creating uncertainty for downstream consumers in aerospace, energy, and defense.

US Efforts

Alumina refining remains the fastest pathway to rebuilding the US gallium stockpile, as most of the metal dissolves into the caustic digestion liquor during processing, with the remainder concentrated in red mud (bauxite) residues.

However, unlike China, the US currently lacks commercial-scale capability to recover gallium from these streams — though projects like ElementUSA’s initiative are beginning to emerge.

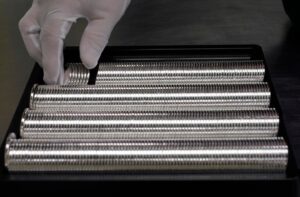

ElementUSA has access to over 30 million tons of mineral-rich bauxite residue and employs a proprietary process to separate and extract both gallium and scandium from it.

“By enabling ElementUSA to recover gallium and scandium from processing waste, this award will support the DOW’s work to expand the supply of critical minerals needed for numerous defense components and platforms,” Acting Deputy Assistant Secretary of Defense for Industrial Base Resilience Jeffrey Frankston said.

“Such awards are essential for reconstituting domestic capabilities, diversifying supply chains, reducing dependence on foreign sources, and enhancing national security.”

Original:

https://thedefensepost.com/2025/11/28/pentagon-elementus-strategic-minerals